The Centers for Medicare & Medicaid Services (CMS) was previously known as the Health Care Financing Administration (HCFA) until 2001. It’s a federal agency within the United States Department of Health and Human Services (HHS) and they administrate the Medicare program and work with state governments to administer Medicaid, the Children’s Health Insurance Program (CHIP), and health insurance portability standards.

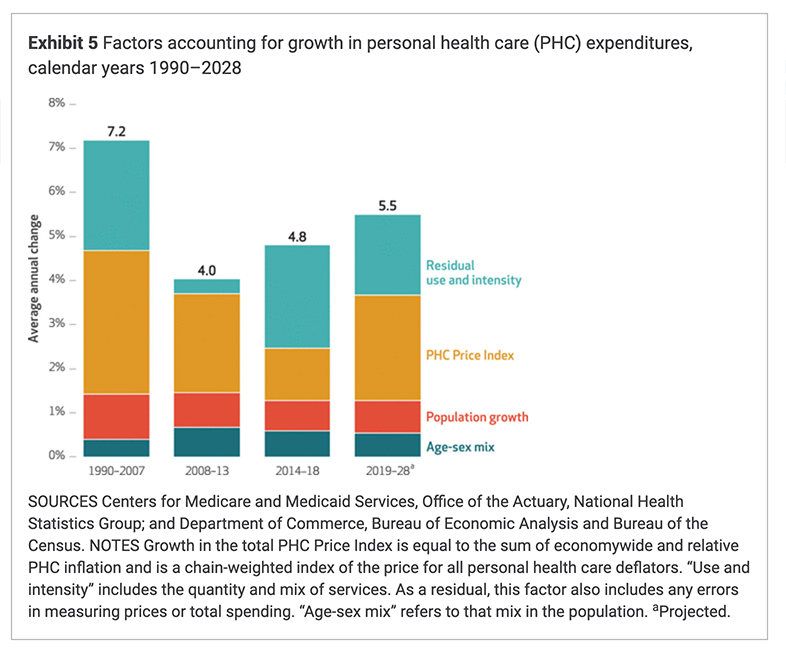

The CMS’ Office of the Actuary published on HealthAffairs.org in March 2020, that national health care spending is expected to increase by 5.4% from 2019 to 2028, which is more than the gross domestic products (GDP) average projected growth rate of 4.3%.

This may not come as a surprise to most Americans who already feel the burden of paying expensive health insurance premiums, with high deductibles and copays. And as a result of the rising costs in the health and wellness industry, many Americans will be investigating ways to save money on their health insurance or at least gain a better insight into why the cost of health insurance is outpacing their income.

In their released report, the CMS estimated national health care spending reached $3.81 trillion in 2019 and would increase to $4.01 trillion in 2020.

Based on this information, we have the cold hard data from a government agency to support the concern that the cost of health insurance is rising, and will unfortunately continue to rise. But if you’re wondering why, then you’re not alone. Many are asking the same question. Is the rising cost due to U.S. governmental policy making? Is it due to higher health care prices? Increases in the cost of prescription drugs, including generic drug pricing? Increases in the average wages paid in the medical industry?

The short answer is yes, yes, yes and yes.

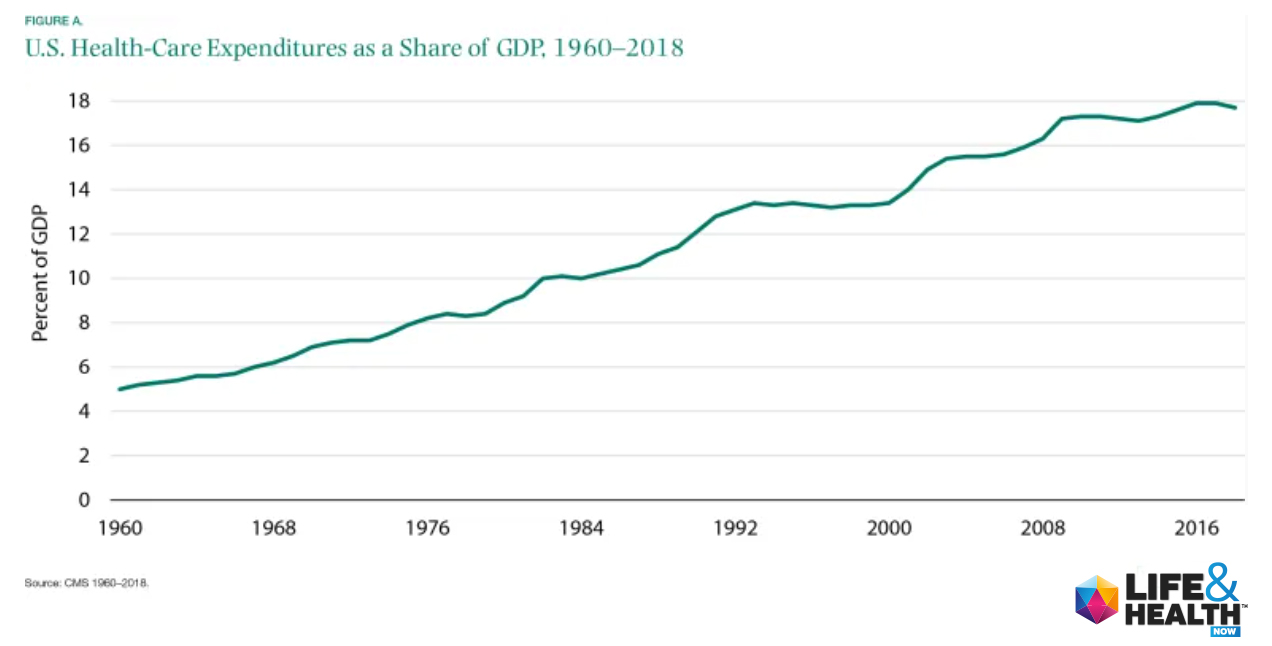

Many changes by lawmakers have made it very difficult to pin point any single factor for the fault of our rising cost of health care in the U.S., but the fact remains that health insurance costs have risen faster than the rate of inflation, becoming nearly 18% of GDP in 2018. So, instead of singling out any one thing, many experts today point to an array of factors which contribute to the higher costs of health care.

When you consider the importance of health and longevity to individuals, you could say that in some ways the health care sector is possibly one of the most critical areas of the United States economy. The success of our health care industry is foundational to our citizens very lives, and therefore critical to our very health and well-being, which directly impacts our ability to produce and thrive as a nation.

Looking at the size and scope of the industry may help to put things into perspective, especially as we consider regulatory controls and its budgetary impact. The health care sector now represents 11% of all jobs in the U.S.

According to the Dept. of Labor and Statistics, Healthcare job growth is outpacing nearly every other major sector of the economy.

Employment in healthcare occupations is projected to grow 15 percent from 2019 to 2029, much faster than the average for all occupations, adding about 2.4 million new jobs. Healthcare occupations are projected to add more jobs than any of the other occupational groups. This projected growth is mainly due to an aging population, leading to greater demand for healthcare services.

U.S. BUREAU OF LABOR STATISTICS

Key Take Aways:

• Health care costs have steadily been increasing for decades. This trend is not likely to change anytime soon.

• In 2019, the U.S. spent $3.81 trillion on health care, $4.01 trillion in 2020, and by 2028 the U.S. will spend $6.19 trillion on national health care.

• The study also found five areas that affect health care costs: a growing population, aging seniors, disease prevalence or incidence, medical service utilization, and service price and intensity.

Feel free to click the links above and read the reports for yourselves, but the bottom line is, there are many factors which are affecting the pricing of health insurance premiums for U.S. consumers.

If you’re feeling frustrated that it seems there is nothing you can do to impact the cost of your health care, we understand. While it is true most of what effects the cost of health care is beyond us, there are factors that relate to us, and we list a few of those below.

- Location: The state you live in or even your zip code where you reside can actually affect your health insurance rates.

- Age: As we age, health insurance becomes increasingly more expensive, so our age is a factor. The need for medical services increases as we age so the health insurance companies pass this increased cost along to those in the related age groups. The increased cost among age groups is even impacting younger adults. The 2020 U.S. Census found that adults between the age of 26-34 paid around 16% more than younger adults between the ages of19 and 26, in 22 U.S. States.

- Tobacco Use: The cost difference between tobacco users and non-tobacco users for health insurance can be as much as 50% more expensive depending on the state in which you reside. The ACA allows insurance companies to charge more for coverage of members who use tobacco, but a few states prohibit tobacco use surcharges (California, Connecticut, Massachusetts, New Jersey, New York, Rhode Island and Vermont), so again, where you live can make a big difference on your health care premium costs.

Speak with a licensed agent today. We're here to answer all of your questions.

Choosing the right life & health insurance coverage for your family is a great way to protect your loved ones. Our licensed agents are here to help. Contact us today to get answers to your important life & health insurance questions.