If you’re living the good life in North Carolina, and thinking about finding the right life insurance protection for your family, then you’ve come to the right place. The fact is, life and death is not a subject that most of us enjoy pondering, but we know deep down, that one day our time in this life will end. We hope that day is postponed as far as possible and the days before are filled with joy and vitality, but no matter how grand our experience here is, or how long it may be extended, there is no fountain of youth. Eventually, the hands of time will catch up with each and every one of us.

Topics Covered On This Page Find exactly what you're looking for by using any of our direct links.

In a hurry? We understand, if you prefer to just receive a quote right away, you can use our Quick Quote request and find the lowest cost, cheapest health insurance premium with the best coverage that fits you or your family today.

While living, we have an opportunity to make our mark, create a legacy or perhaps leave a proverbial dent in our very own corner of the universe. For better or worse, we can and often will have an impact long after we are gone.

When our final day does arrive, most will be survived by family and friends who will remember our funny stories, thoughtful words, kind acts, as well as the many meaningful moments and special occasions that we shared together.

By choosing the right life insurance policy, we have yet another way of leaving something else behind, it’s often called, financial protection.

The name for this “financial protection” by way of life insurance, which is paid to the beneficiaries in a lump sum, is known as the “death benefit.”

By having a life insurance policy, the living are able to provide a pre-determined amount of money to be paid to one’s heirs and/or designated survivors upon their death.

While nothing can replace the loss of a loved one, proper financial planning can provide a layer of comfort and protection for your family. For many, it’s the thought of the financial pressure and stress that will be added to their grieving families burden which motivates them to provide adequate life insurance protection.

North Carolina Life Insurance Facts & Figures

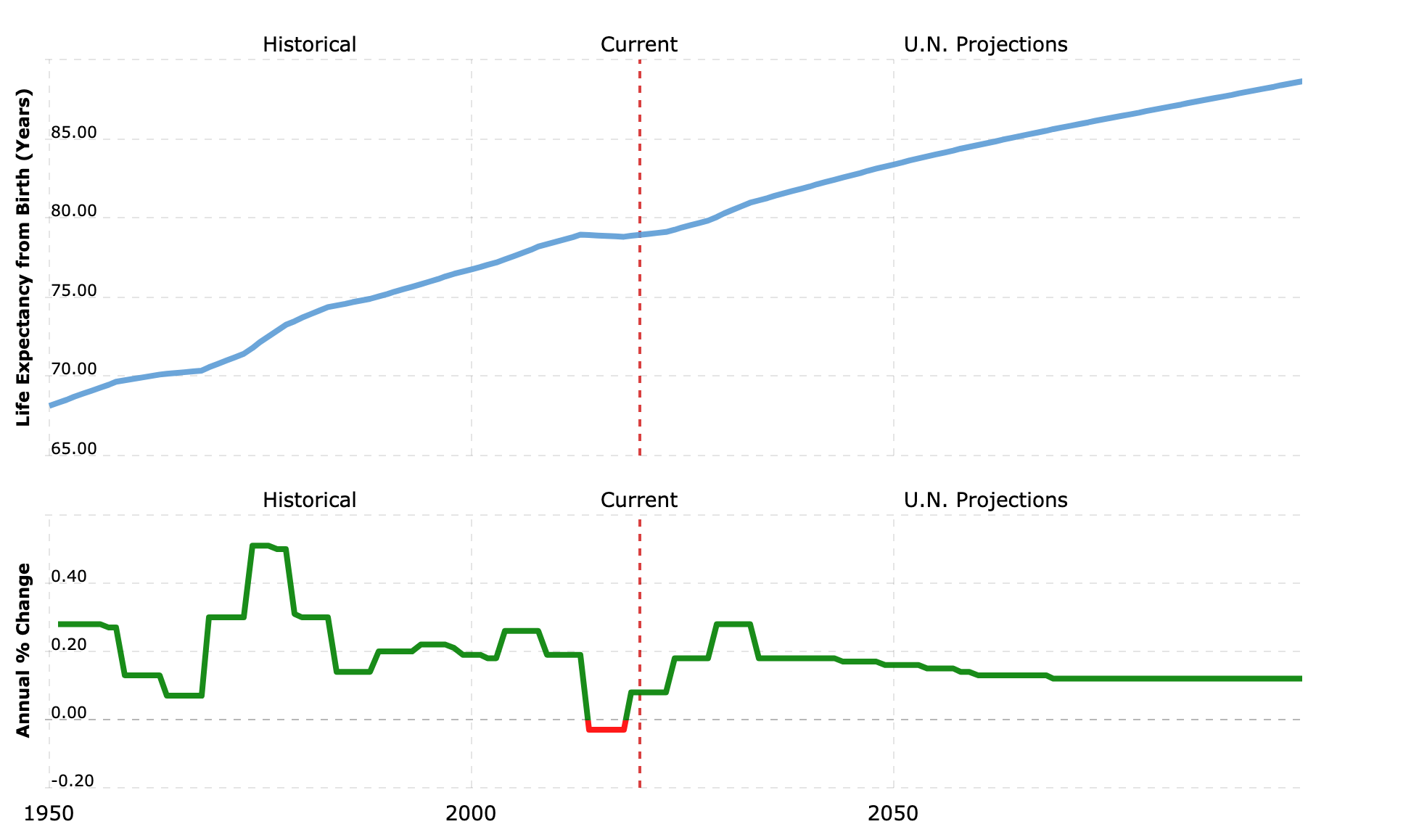

The average life expectancy in the U.S. is 78.7 years and 54% of the U.S. population has a life insurance policy. Below we can review the statistics for North Carolinians and see how North Carolina compares with the rest of our country:

- North Carolina life expectancy for males: 75.3

- North Carolina life expectancy for females: 80.7

- State rank for life expectancy: 37

Why Choose Us?

What makes Life & Health Now stand out in today’s market, is our professional and friendly team. Our focus is on delivering value and positive health care shopping experiences to each and every client.

As a team, we don’t settle, and we are all in it together; we apply this thinking to help our customers thrive and live better lives by eliminating their concerns over choosing the right insurance provider.

Cheap Life Insurance in North Carolina:

What is Life Insurance?

Life insurance is a written agreement (contract) between an insurance company and a policy holder.

The purpose for a life insurance contract is to pay a specific amount of money (death benefit) to the named beneficiaries, when the insured dies. This contract consists of payments from both parties. The insured agrees to pay the insurance company in the way of an agreed premium (usually monthly or annually) and the insurance company agrees to pay the named beneficiaries (this may be one person or more than one person) an agreed upon amount, at the time of the insureds death.

To illustrate, let’s use an example:

Mike and Sue are married with two young children. They wish to purchase a Term Life Insurance Policy to protect their family from financial hardship, in the event that one or both of them were to die unexpectedly. After consulting with a licensed insurance agent and reviewing their options, they decide to purchase a 20 year term life insurance policy. The insurance provides them with a safety net of financial security, as well as increased peace of mind. Upon the death of either spouse, the surviving spouse would have the necessary funds to continue raising the kids without fear or worry over how they will be able to pay the bills.

Key Terms:

Let’s review a few of the life insurance terms in the scenario above, Mike and Sue are the insured. Their Term Life insurance contract is one form of life insurance, and this agreement (or contract) is also called the policy. Mike and Sue are the beneficiaries of the policy. Their monthly insurance payments, paid to the insurance company are the premiums. The amount paid at the time of their death from the insurance company is called the death benefit.

IMPORTANT CONSIDERATIONS:

- Life insurance is a legally binding agreement/contract.

- In order for the agreement (contract) to be valid, the insured must provide an accurate and honest account on their policy application describing and detailing their health history, as well as any possible high risk hobbies or activities they might engage in.

- The policy holder is responsible to make timely payments in accordance with the terms of the policy contract which may stipulate monthly payments, annual payments or even a single one-time lump sum payment, but whatever the terms of the agreement state, the policy must be paid as agreed, otherwise it will not be enforceable.

- The death benefit or face value of the life insurance policy will be paid to the named beneficiaries (or their heirs, in the event of the beneficiaries death) upon the death of the insured.

Different Types of Life Insurance Let's review the most common types:

Most life insurance can be simplified into two basic categories, Whole Life and Term Life insurance. To keep things simple, there is a common form of life insurance that combines lifetime death protection insurance coverage with a cash value feature. This type is often called Whole Life or Universal Life. You may think of this kind of life insurance as serving multiple functions. Should you die while covered by one of these types of policies, generally your family (the named beneficiaries) will receive a payment from the insurance company (you will recall from earlier in our article that this payment from the insurance company is called the death benefit). There is also another feature that works similar to a savings account and that’s the “cash-value” portion. It’s important to know that legally and technically, it’s not really a “savings account” but there are a few similarities. The cash-value portion of the policy accumulates a certain amount of cash- value over time, and it can be “borrowed” from while the insured is still alive. Some people like this feature as it can provide access to funds when an unexpected need arises. It’s normally the more expensive form of life insurance and there are important considerations that we will cover later in this article, but for now, that’s the first of the two groups of life insurance that we are going to cover, and again, life insurance policies which are in this group are often referred to as Whole Life Insurance.

The other very popular type of life insurance that you’ll hear people talk or write about is called Term Life insurance. As the name implies, Term Life is only valid for a specified period of time (example: 5, 10, 20 or 30 years) and unlike Whole Life or Universal Life, it does not build up cash-value over time. Term Insurance serves a single function. If the insured dies during the term of the policy, the insurance company will pay the agreed upon sum (death benefit) to the policy’s beneficiaries. Term Insurance is normally the simplest to understand and most affordable type of life insurance available.

Whole Life vs. Term Life Insurance What are some of the pros and cons...

Whole Life is insurance that you can keep for your whole life. You never have to worry about it expiring after a certain period of time. You could purchase it when you’re 30 and be covered when you’re 102. As the name implies, Whole Life covers you for as long as you live and as long as you keep making your monthly payment. Because it combines cash-value and life insurance, the cost is more expensive than its popular alternative Term Insurance.

- Whole Life & Universal Life Insurance plans: You may also hear the term Permanent life insurance. These are life insurance policies which remain active until the insured dies, stops paying premiums, or surrenders the policy. As premiums are paid, the cash-value builds up. Over time as the cash-value of the policy increases, the insured may be eligible to borrow from the cash-value balance, in the form of a loan. With a Universal Life Insurance policy the cash value may be eligible to make future premium payments.

As your premiums are paid, a portion of your premium is credited towards the policy’s cash value. Once the cash value has reached a certain amount, you are able to borrow from the insurer using the cash value portion of your policy as collateral for the loan. Since the loan is secured by your policy, their is no credit application requirement for this type of loan. Most insurance companies are flexible with regard to how the loan is repaid but if the balance of your loan, plus interest, exceed the value of the policy, then the policy will be canceled. The same rule would apply if you wanted to withdraw all of your accumulated cash value. You could, but you would no longer be insured – which means you will have no life insurance protection for your family when you die. This is where many critics of Whole Life and Permanent Life insurance point out that it is not the best value option available when compared to most Term Life insurance policies.

Please keep in mind that each policy has it’s own terms and conditions that should be read and understood in order to make a formal comparison, but in general the argument against this type of insurance is due to the “cash-value” feature and the additional premium cost associated with life long insurance which never expires.

In the end, you’re paying for cash-value and life insurance but you only get one or the other (and the death benefit is considerably less). The typical purchaser can expect to pay anywhere between 5 to 15 times more for the same death benefit coverage as compared to term insurance.

Let’s assume that you and your spouse have a Permanent life insurance policy that covers both of you with a $50k death benefit. Let’s also assume that you make your payments for 30 years. Then one day your spouse becomes ill and passes away. You remember that you have a $50k policy but you might also expect that after 30 years of payments, your cash-value portion has accumulated a pretty significant amount as well, right? You add up your years of payments and you find that $300/mo x 30 years…is a total of $108,000 that you paid in premiums over the years. Wouldn’t you be surprised if you learned that your cash-value was also equal to $50k? To be clear, we’re just making up a hypothetical situation here. This is not an actual client. But the story serves to illustrate an excellent point. Many people would conclude that they have around $100k coming their way from the insurance company but they would be wrong. You see, with most Permanent Life Insurance policies, you will only have access to one or the other. This means you will either walk away from the cash-value or the death benefit. We already covered what happens if you withdraw all of your cash-value from the policy. Your policy will be canceled. So, what happens if you use the death benefit. Well, in that case you will forfeit the cash-value. It’s kind of a lose, lose situation. You lose one or the other benefits, and you paid a whole lot more for a very long time, for a very little amount of insurance. Where $50k may have been a significant amount 30 years ago, it’s not very significant today. Contrast this with paying $30/mo for $500k worth of insurance for 30 years of Term Life Insurance. For starters, $500k in protection is a lot more than $50k in protection. And the monthly cost difference is $270. That’s a lot of money that you could have saved. If you truly saved $270 each month for 30 years, and your spouse died in the 30th year, you would receive $500k from the insurance company in the way of the death benefit, plus you could have accumulated a nice balance in your own savings, investment or retirement account. Even if you stuffed it into your mattress, you would have accumulated $97k at zero interest. I must add, this is not financial advice, or investment advice. The purpose here is to inform and encourage you, the reader, to do your own research. We also recommend that you call us and speak with a licensed agent who can assist you with your questions and provide you with professional assistance in selecting the right life insurance policy for you and your family.

- Term Life Insurance Plans: Term life insurance policies expire after a certain number of years. This type of insurance does not work like a “savings” account and has no cash value. Sometimes called a “surrender” value. Simply put, this policy is a death benefit policy only. No portion of the premium (monthly or annual policy payment) is set aside into a savings or interest earning account. It is typically the least expensive of all life insurance policy options.

Speak with a licensed agent today. We're here to answer all of your questions.

Choosing the right life insurance coverage for your family in North Carolina is a big decision. Our licensed agents are here to help. Contact us today to get answers to your important North Carolina life insurance questions.

Editorial Disclosure: The information published within this article is based on the author’s view. The opinions and recommendations expressed here have not been reviewed, submitted for review, or acknowledged by any of our network providers or partners.