Could you decide to not purchase health insurance until you are sick? Yes, you absolutely could wait until you’re sick, if you really wanted to do so, but the real question is, should you?

Let’s ask a slightly different question…is avoiding health insurance a reasonable and rational alternative to health insurance?

That’s an altogether different question, right? I thought you might agree. So, for anyone who may be seriously considering this as their health care strategy, I decided perhaps we should look into the reasons why people might think about taking the risk, and also what might be the consequences of such a choice.

If you roll the dice and end up having a medical emergency or serious medical diagnosis, you may find yourself liable for a much more expensive medical bill in comparison to what your pocket insurance costs might have been. And in case you haven’t gone for a while, going to see a doctor and/or hospital is not cheap. A major medical emergency could easily drain a person of their life savings and leave them holding a massive bag of debt, to boot.

According to the 2020 Census, only 8% of Americans are uninsured. So, if you’re into playing the odds, you’re already in the minority of people who think this is a good idea. In other words, 92% of Americans do not think this is a gamble worth taking.

Some of those that are in the 8% category may be by choice, meaning they have consciously decided to actually take the risk that we’re diving into here in this article, but others maybe find themselves uninsured due to a job change, unemployment, or because they don’t truly understand their insurance options. Regardless of why, we can at least take away that the total uninsured market, at around 8%, is a pretty small minority at this point and clearly not the popular choice.

You might say, but what about the changes to pre-existing conditions? Since the passage of the ACA, even if I get a dreaded disease, insurance companies can’t turn me away, right?

Okay, great question, let’s unpack it.

Yes, you’re correct, the Affordable Care Act (ACA) does require that insurance companies must accept all applicants, as well as require them to adhere to strict benefit guidelines which require all participating insurance companies to offer a standard set of 10 essential health care benefits. This is one of the many great things to come out of the Affordable Care Act, in my humble opinion.

So, factually, you are correct, you can no longer be excluded or refused coverage based on a pre-existing condition. However, this does not apply to short-term insurance, which is offered and sold throughout the year, and is not regulated or bound by the same regulations of the ACA.

If you don’t already know, you can only sign up or enroll for health insurance from the ACA Marketplace during the open enrollment period. The open enrollment period is typically only 6 weeks, and most often it’s the weeks between Nov 1st and Dec 15th, (with coverage beginning on Jan 1st of the following year), that’s a long time you could potentially be waiting to enroll and the odds are, you might not end up rolling a winning hand. You could be left without insurance coverage for a very long time before your pre-existing condition argument is even a factor. And your argument for obtaining insurance based on not being refused based on having some dreaded disease is probably starting to, well, not look so great. Agreed?

Look, we’re here to help not make you feel bad. We understand that you may be concerned about the costs, but you also have to think about the risks that come with certain “unknown” costs. So, please don’t misunderstand our intent. We’re here to help those who are looking for health insurance to find affordable health insurance, and to help them avoid a financial disaster, while living a healthy and peaceful life.

Also, keep in mind, if you’re thinking you’ll sign up for health insurance from your employer, most employers have even shorter open enrollment periods, each year, than the exchanges.

Private companies who offer their employees insurance have the freedom of setting their own open enrollment periods. Because of this, it’s impossible for us to know the exact dates you would need to enroll for health insurance, but many companies do wait until the end of the year, or around the open enrollment period offered with the ACA Marketplace. It’s really up to where you work, so be sure to speak with your HR department and ask them about the open enrollment period at your company.

Ultimately, we’re here to provide solutions. We want to encourage you to be thoughtful about your decision. Think it through, and if you’re considering this as a means of saving money, just realize it could also cost you much more in the long run. Don’t be left on the outside looking in and wondering why you decided to take the risk.

WHAT ABOUT THE PENALTY FOR NOT PURCHASING HEALTH INSURANCE, IS THAT STILL A THING?

Actually, let’s first say that this blog does not offer tax or legal advice. But, as far as we can tell you, that is no longer a thing. You will not be subject to tax penalties in 2021 for not purchasing health insurance. This change became effective January 1, 2019. U.S. citizens are not currently penalized for not purchasing health insurance. This could change, but for now, you’re safe. This was due to congress passing the Tax Cuts and Jobs Act of 2017, eliminating the individual mandate penalty.

The bottom line is, yes, you absolutely could decide to not purchase health insurance, but the risk of getting sick and not being able to purchase health insurance when you need it most, that is the compelling reason for not making such a choice.

Hopefully this helps you in making your decision. If finances are holding you back, don’t hesitate to connect with us via the button somewhere on this page to request a quote. You may qualify for a subsidy and be surprised at how affordable your health insurance can be.

Below we will cover some of the reasons why the costs of health insurance are increasing. We will also cover how you may be able to take advantage of the subsidies offered by way of the ADA, which may bring your costs of health insurance to a more manageable level that you can afford.

I WANT HEALTH INSURANCE BUT IT’S EXPENSIVE, WHAT CAN WE DO?

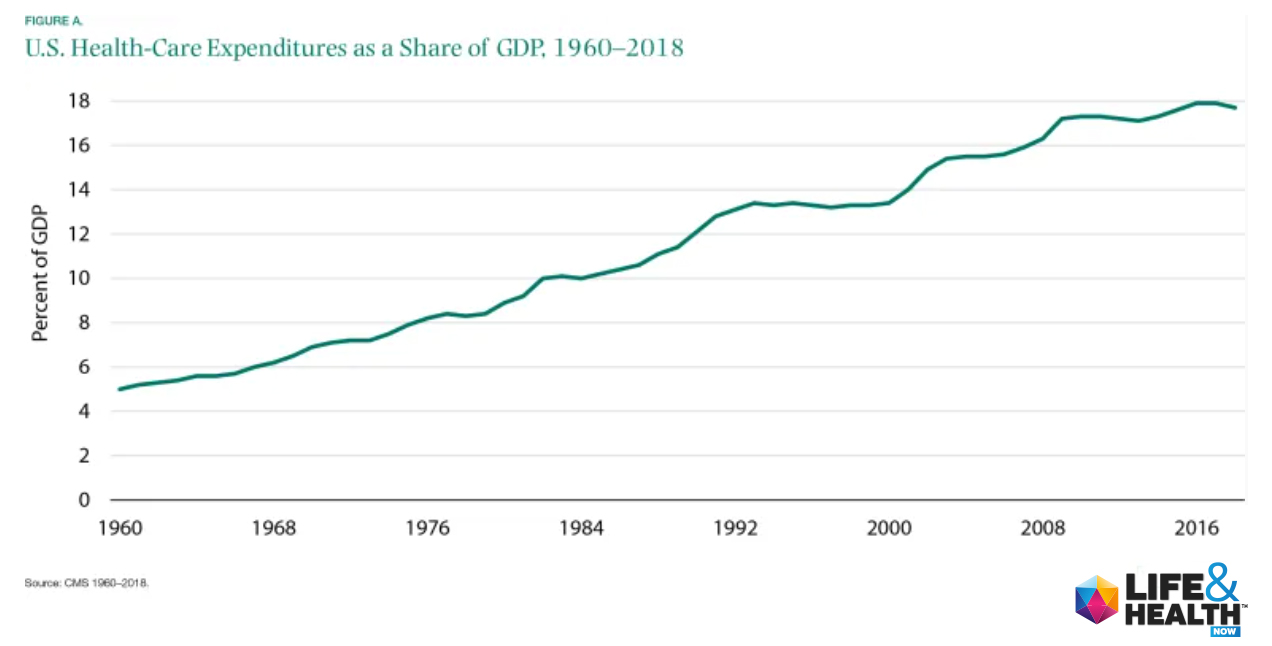

For starters, we agree, and you are correct. Health insurance is expensive and the costs are likely to keep increasing due to many factors such as an increased demand in the U.S. health sector.

That means an increase in sick people who are facing health challenges such as obesity, diabetes, high cholesterol, cancer, heart disease and hypertension just to name a few. Conditions like these can require expensive therapies and long-term care, which puts a significant strain on the overall health care costs for everyone.

So, the number of increasing sick people definitely adds to the cost of health insurance, but that’s not all, we also are experiencing an increase in our overall average lifespan.

Yea…we’re living longer!

But yes, it’s going to cost us…

So, the problem is really basic arithmetic. If we add up the number of increasing sick people, plus the number of Baby Boomers who are entering retirement age, we can see we’re heading for many years of increasing health care costs, and thereby increasing health insurance premiums.

According to the U.S. Census, older adults will outnumber children under the age of 18 for the first time in US history by 2034.

And according to the National Institute of Health, by 2030 all Baby Boomers will be between the ages of 66 and 84.

That’s a lot of Baby Boomers. According to American Mobile, the over 65 age group will have tripled in size, in comparison to 1980. And according to Forbes, by 2050, there will be 83.7 million people over 65 years, compared to 43.1 million seniors back in 2012. That’s nearly double the number of seniors.

And among the older boomers, those born prior to 1946 (the oldest of the group) this group is estimated to total around 9 million by 2030. This is the group that is expected to have the highest medical care costs of all age groups.

Let’s talk about the expected costs of medical care for the elderly. Fidelity Investments has estimated by 2033 the out of pocket costs for health care for a 65 year old couple will be $275,000, and this figure doesn’t include the costs of rehabilitation or long term nursing care. This leaves less than 50/50 odds that our aging seniors will be able to afford the cost of their own medical and health care expenses.

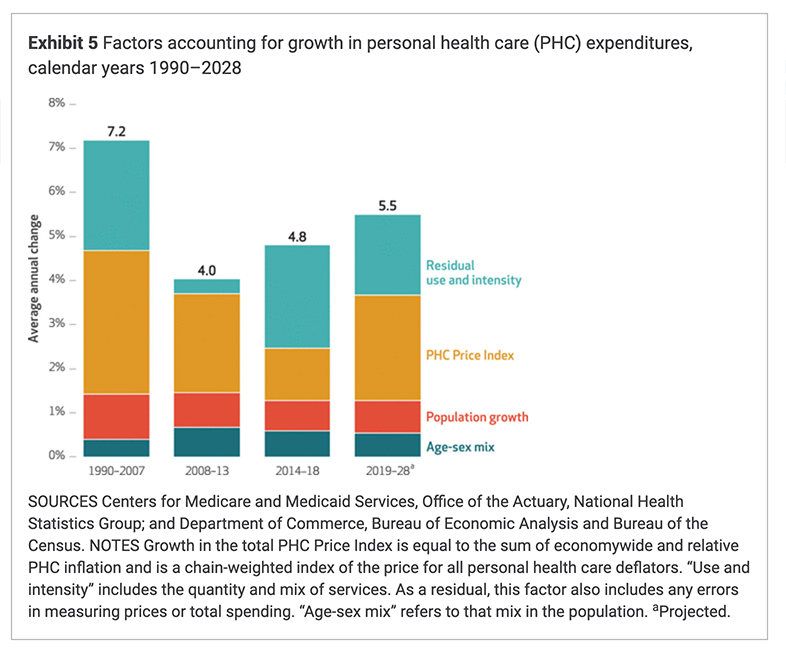

The increase in sick and unhealthy people who will need medical assistance with services such as diagnosis, therapies, surgeries and pharmaceutical drugs, will continue to add more demand for professionals in the health care profession and are very likely to further drive up wages in this industry.

Unless you have a magic wand or some means of helping to significantly reduce the number of sick people and people with disease, this upward trend in pricing is unfortunately going to continue.

Higher industry demands results in higher wages to attract more people to enter the healthcare profession, as well adding to the increasing cost of goods and services, hospitalizations, prescription drugs, buildings and everything else that impacts to the entire medical ecosystem.

These increases eventually impact the cost of every day Americans like us, and what we ultimately pay for our health insurance and health care.

You might even say the cost has exploded in comparison to the slow increase of most salaries and wages in most other sectors of our economy.

If you’re feeling the financial pinch, when it comes to the rising cost of health insurance, you’re not alone. We understand your frustration and we are here to help provide guidance with your search for the right health insurance policy.

When you contact us, you’ll speak directly with a licensed agent who will work with you to see if you qualify for a health care subsidy, and if not, will help assist you with finding a health insurance policy that will fit your budget and needs.

So you may be asking what exactly then does the Affordable Care Act (ACA) aka “Obamacare” do? For starters the ACA made health care accessible for millions of Americans through the ACA Marketplace or “exchanges.”

According to census.gov in 2019, the percentage of people with health insurance coverage for all or part of 2019 was 92.0 percent.

It also provided subsidies to assist low income U.S. families to help make health insurance more affordable. Keep in mind, like we said before, not everyone will qualify for the subsidies, but if you do, then it will definitely help save you money on your health insurance costs.

DO YOU QUALIFY FOR A SUBSIDY?

Qualifying for a federal tax-subsidy is based on your annual income and the size of your household. In order to qualify in 2021 your income is required to be between equal to or not more than 4 times that of the federal poverty level (FPL). If you prefer percentages, you could say between 100% and 400% of the federal poverty level (FPL). Either way, works out to the same. The qualification rules are measured against the prior years poverty level. This means for 2021, that health insurance plans are measured against a persons total projected income for 2021 but in comparison to the 2020 poverty level guidelines.

Let’s use an example.

For 2021, if you’re a family of four and earn between $26,200 to $104,800, you would qualify for the federal subsidy.

For a married couple with no children, a couple would need a combined household income of no more than $68,960 in order to qualify for a 2021 health subsidy.

Also, don’t forget we’re talking about your total income for the year, so you’ll need to estimate how much you’ll earn for the entire year. Don’t just look at your paycheck year to date (YTD) column in November, if you expect to continue collecting a paycheck for the month of December. If you need help estimating your annual salary you can find a variety of online calculators that can help you total up your annual income.

For more information on qualifying for health care subsidies, reach out to us today by clicking on the button below and starting your request for a personal health insurance quote. You’ll have direct access to a licensed agent that will work with you to get the answers you’re looking for and a policy that will work for your family and needs.

Speak with a licensed agent today. We're here to answer all of your questions.

Choosing the right life & health insurance coverage for your family is a great way to protect your loved ones. Our licensed agents are here to help. Contact us today to get answers to your important life & health insurance questions.