Topics Covered On This Page: Click on any of the links below and proceed to the section.

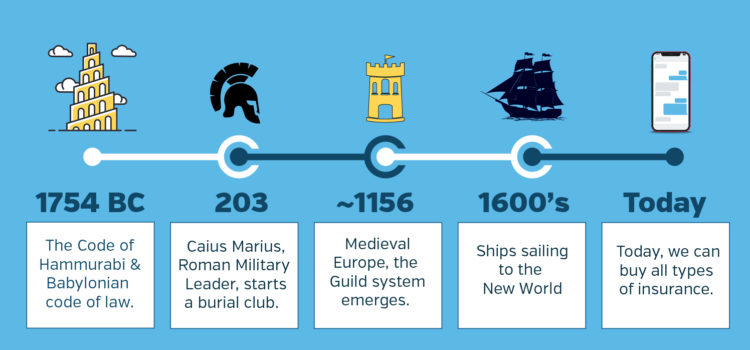

Who Created Insurance?

Have you ever thought about who came up with the idea of insurance? Let’s look at the history of insurance and how it evolved into the financial protection that billions have come to rely on today. You may be surprised to learn that insurance as a concept dates back several centuries.

Have you ever heard the phrase, “safety in numbers”? Our ancestors knew this back when they hunted as a group, or built villages and tribes. In most cases, as the group increased, so did their individual odds of survival. If we think of it, limiting risk and spreading the risk of injury to any one particular member isn’t all that different than what insurance companies provide for us every day.

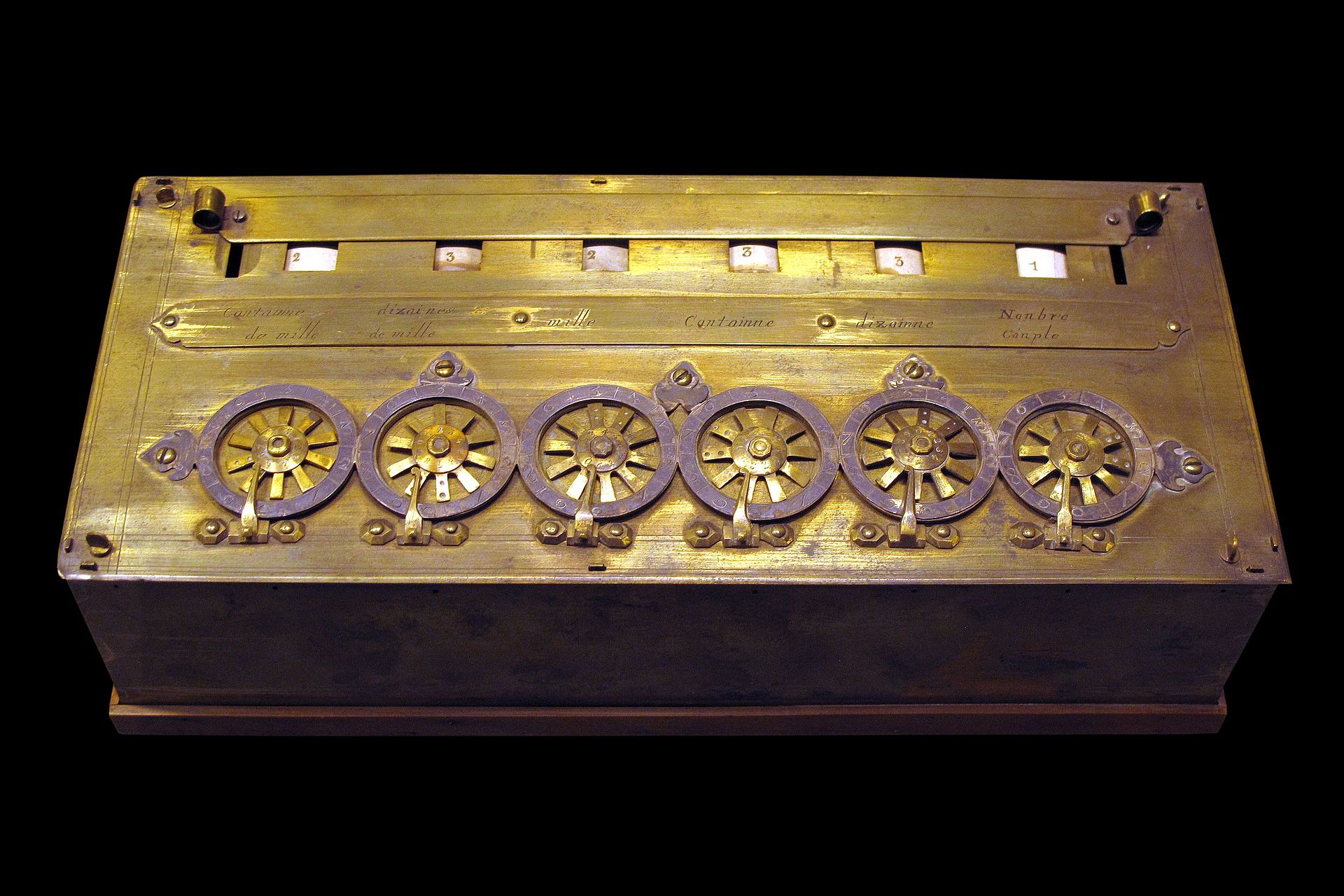

As time progressed, we developed more sophisticated ways of calculating and found new ways to determine more accurate probabilities.

In 1645 Blaise Pascal presented the worlds first calculator to the public (which he called the Pascaline) and went on to build approximately twenty more machines during the next decade. Nine of Pascal’s adding machines have survived to this day and most are on display in European museums. In1654, he teamed up with Pierre de Fermat, and together they laid the foundations for probability theory. Together their new found theories helped to transform the world of insurance and underwriting (we’ll dive deeper into that topic a little later), leading the way for more affordable insurance through the use of more accurate predictions of potential financial losses.

Science and business have a long history of working well together, and have contributed greatly to the success of the societies who have taken advantage of this teamwork. Where would Tesla be without a predecessor like Henry Ford, or so many of our must-have electronics and gadgets, without the ideas and electricity of Thomas Edison? Science and business do go well together, and the development of mathematics as a technology is no exception.

Statisticians use the science of data to make informed decisions, and insurance companies are but one example of putting this science to a practical use in business, and our lives today are a whole lot less risky as a result.

Just imagine the financial impact of a few of these examples:

1. Having to pay the collision repair bill for every fender bender, in a world without auto insurance.

2. Having to pay cash for every medical emergency and operation, without health insurance.

3. What about owing the bank for the total balance of a mortgage for your home that accidentally catches fire and burns to the ground because there was no such thing as home owners insurance?

4. What about a family with several small children that’s struggling to survive the devastating financial loss of a parent, because there was no such thing as life insurance?

These problems are just as real and practical as the shoes on our feet or the refrigerator in our kitchens. We may not think about them all that often, but lucky for us, someone who came before us did. And today there exists some form of insurance for each one of these situations and a whole lot more.

We hope you enjoy our brief overview of the history of insurance, and we look forward to assisting you with your insurance needs.

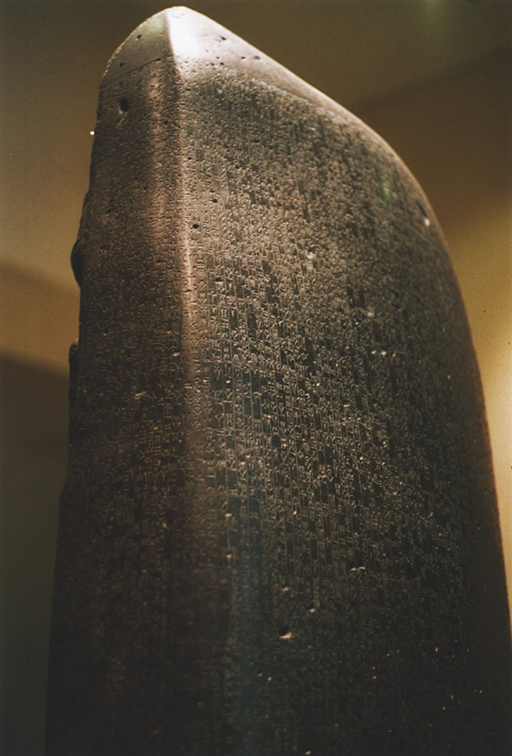

King Hammurabi's Code

According to researchers the ancients had their own form of insurance. It was during the time of King Hammurabi of Babylon, who reigned from 1792 to 1750 B.C., where we find a written record of the nascent roots of financial protection for debts.

King Hammurabi had a very large, pillar shaped, black stone slab erected with 282 laws written on the stone. A partial copy of the well preserved text exists on a 7.4 ft stone carved into the shape of an index finger. The ancient Babylonian monument in which the code was inscribed remained undiscovered until 1901, when it was found by modern archaeologists.

King Hammurabi was the sixth king in the Babylonian dynasty (present day Iraq). The 282 rules in his code of laws, determined the standards in commercial interaction, as well as the fines, penalties and punishments for breaking them. Nearly half of the code deals with matters of contract, establishing the wages to be paid to an ox driver or a surgeon for example. Other provisions set the terms of a transaction, the liability of a builder for a house that collapses, or property that is damaged, among many other rules for their society. It’s also where we get the famous phrase, “An eye for an eye, and a tooth for a tooth.” line.

While it may not necessarily resemble insurance in the way that we think of it today, his code of laws would have most certainly been valued and appreciated as a legal means of financial protection, like insurance is today, for those who lived and benefited from it’s creation.

For example, Under King Hammurabi law, a debtor was not required to repay a loan, in the event of a catastrophe which resulted in the repayment being out of the question, such events would have included earthquakes, flooding, disability, or death.

Who Is Caius Marius

It’s been said, that all roads lead to Rome so you may not be surprised to find that our journey to the origins of insurance has taken a turn down one of the ancient roads of Rome.

It’s been said, that all roads lead to Rome so you may not be surprised to find that our journey to the origins of insurance has taken a turn down one of the ancient roads of Rome.

According to the religious beliefs of many Roman soldiers, if one wanted to find peace with their soul in the afterlife, certain burial rituals were required. And for this, Caius Marius, a Roman military leader, started a burial club where members would each contribute monthly payments that would cover the cost of these elaborate burial ceremonies for its members.

While it may not have been known by the same name, the concept is very similar to what we have come to know today as, life insurance.

The Guild System Protected its Members

As time progressed, other societies developed methods to offset their financial burdens and attract new members to their trade. And that brings us to the Middle Ages where the British Trade Guilds practiced a form of group insurance to support & protect its members. Especially, among the larger, more established Guilds.

As time progressed, other societies developed methods to offset their financial burdens and attract new members to their trade. And that brings us to the Middle Ages where the British Trade Guilds practiced a form of group insurance to support & protect its members. Especially, among the larger, more established Guilds.

Most craftsmen started as apprentices in their youth working for little or no pay to learn their craft from a master craftsman. Upon attaining mastery, they would pay dues to the guild, hire and train their own apprentices and the cycle would again be repeated. In exchange, the guild would provide financial protection and ensure the master’s business would survive unfortunate events such as robbery, injury, fire and even death.

The more established guilds would also provide financial support for the master’s family. Again, it may not have been called life insurance at the time but the concept was there, and from its humble beginnings, we can see that our ancestors thought about and dealt with very similar issues to those that we face today in modern times.

Insurance Sets It's Sail

In the late 1600’s ships were just beginning to set sail and trade between the Old World of Europe, to the new and exciting lands, which they called the New World.

Located near the docs of London, were coffee shops where many of the men from these long journeys would gather and swap stories.

Located near the docs of London, were coffee shops where many of the men from these long journeys would gather and swap stories.

Sounds a little like the modern coffee shops of our time, doesn’t it?

I can close my eyes and just imagine the delicious aroma of pumpkin spice latte in the air…

Hang on a second, my imagination may have run wild there for a bit, but I can most certainly imagine the smell of fresh ground coffee in the air, and a room full of laughter and roaring voices telling fascinating stories of the sea, complete with their adventures of the new and far away lands.

I can hear conversations buzzing with excitement, while members of the community listen with great interest to capture more about this mysterious place called, the New World.

Today, we get together on social media to view and share our exciting discoveries, tall tales, travel and adventure, and of course entrepreneurial experience (I’m sure social media has already taught you how to make a million dollars online while you sleep), but for those who lived in London in the late 1600’s, and wanted to get their news first hand, there was no better place to be than the local coffee shops along the ports of London.

Hot coffee, wonderful stories and tall tales were not all that was going on in these coffee shops. This was also a great place to talk business and find venture capital for funding new voyages.

Hot coffee, wonderful stories and tall tales were not all that was going on in these coffee shops. This was also a great place to talk business and find venture capital for funding new voyages.

The late 1600’s were an exciting time to be alive. The maritime merchants understood the financial risk for sailing to the new world were high, but they also knew their potential rewards were high. The colonies were forming in the New World, and full of new and rare and exiting finds of cargo, like tobacco, that were starting to make their way back to Europe.

The local smart business investors smelled more than coffee brewing, they smelled opportunity. Not only were there excellent merchandise opportunities to bring home for a nice profit, but there was a growing population of colonists who relied on the transport of goods and supplies from the Old World to the New World. However, merchants wanting to sell their goods faced the pressure of possibly losing everything in such a voyage. The mariners and ship owners risked losing even more, their very lives, as well as their fortune if they lost their cargo in route.

The coffee shops played a vital role in shaping the future of such voyages as well as the risks to all concerned. And they even eventually formed the foundations of the unofficial stock exchange for the British Empire.

There’s one coffee house in particular that we want to focus on, and the owner of that shop was none other than Edward Lloyd. In 1769, a small group of men formed New Lloyd’s Coffee House, which later became Lloyd’s of London. It became known as the place to go for ship owners and merchants seeking insurance. It was a gathering place for those needing insurance and those offering insurance, it eventually became a leading insurance marketplace. Lloyds of London is the oldest and most successful insurance marketplace to this day.

The vessel owners who understood how to navigate and sail to the New World could now afford to fund their trips through the help of their financial backers (venture capitalists), who would in turn receive a share in the returning goods and cargo brought back from the colonists of the New World.

The vessel owners who understood how to navigate and sail to the New World could now afford to fund their trips through the help of their financial backers (venture capitalists), who would in turn receive a share in the returning goods and cargo brought back from the colonists of the New World.

The ship owners and merchants who wanted to sell goods to the New World would bring their ships manifest to Lloyds. Those willing to invest could read the list of items to be carried and sign their names to the bottom of the list, next to a figure representing the amount of cargo for which they would bear financial responsibility.

UNDERWRITING

They were literally “underwriting” the ]voyage by writing their names under the list of cargo on the ship’s manifest document. These businessmen also practiced underwriting multiple vessels of cargo to help spread their own financial risk of loss.

It took a long time to get to where we are today, but as you can see, the rest is history. A new business practice was born through the underwriting of maritime ventures. Today, we simply call this practice, getting or buying insurance.

Speak with a licensed agent today. We're here to answer all of your questions.

Choosing the right life insurance coverage for your family is a great way to protect your loved ones. Our licensed agents are here to help. Contact us today to get answers to your important life insurance questions.